The Role of ETOPay in Bridging Traditional Finance and DeFi for Enterprises

In an increasingly hybridized financial ecosystem, enterprises are seeking ways to merge the efficiency of traditional finance (TradFi) with the innovation and decentralization of DeFi. As of mid-2025, this convergence is accelerating, driven by regulatory advancements, tokenization of real-world assets, and the demand for secure, scalable solutions. ETOSPHERES, part of the ETO GRUPPE, is pioneering this bridge through its mission to deliver EU-compliant Web3 infrastructure that emphasizes data sovereignty. ETOPay, our flagship SDK, enables enterprises to create hybrid models that integrate crypto transactions seamlessly into existing systems, fostering efficiency without sacrificing compliance or control.

Understanding the Bridge: TradFi Meets DeFi

Traditional finance offers established structures like banks, regulated markets, and fiat systems, while DeFi provides borderless, transparent, and automated alternatives via blockchain. The hybrid model combines these, allowing enterprises to leverage DeFi's low-cost lending, yield farming, and tokenization alongside TradFi's stability and compliance frameworks.

Key trends in 2025 highlight this integration:

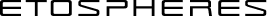

- Tokenization of Assets: Real-world assets (RWAs) like real estate and bonds are being tokenized on blockchains, unlocking liquidity. Tokenized private real estate funds are projected to reach US$1 trillion by 2035, with a market penetration of 8.5%. Overall, tokenization markets have hit $24 billion in 2025 and are expected to grow into the trillions.

- Institutional Adoption: Over 80% of global banks are anticipated to offer DeFi-enabled services by 2026, signaling mainstream integration. This includes stablecoins for everyday payments, with projections for widespread consumer and business use.

- Cross-Chain Interoperability: Solutions enabling seamless interactions across blockchains are reducing silos, facilitating hybrid finance.

These trends are transforming industries like finance, mobility, and energy—sectors where ETOSPHERES excels.

ETOPay's Innovations: Enabling Hybrid Models for Enterprises

ETOPay serves as a critical tool in this bridging process by providing an easy-to-integrate SDK that supports both fiat and crypto transactions. Key features include:

- Seamless Fiat-to-Crypto Conversions: Enterprises can embed in-app ramps, allowing users to convert currencies without external redirects, blending TradFi gateways with DeFi wallets.

- EU-Compliant Infrastructure: Built-in GDPR compliance, automated tax calculations, and invoice generation ensure hybrid operations meet regulatory standards, reducing risks for enterprises.

- Scalable Customization: Through REST APIs and white-label options, ETOPay adapts to enterprise needs, supporting high-volume transactions in sectors like automotive or energy infrastructure.

This enables hybrid models where, for example, an energy company tokenizes assets for DeFi lending while maintaining TradFi reporting.

ETOSPHERES' Mission: Prioritizing Data Sovereignty

At the core of ETOSPHERES' approach is a commitment to data sovereignty—empowering users and businesses to own and control their data in a decentralized world. Founded in 2023 as part of the ETO GRUPPE, ETOSPHERES draws on decades of experience in secure transaction systems and GDPR-compliant data management to build Web3 and Web2 tools and hardware that don't compromise privacy. For example the caritag is a 70-gram tracking device for children, elderly individuals, and people with care needs. It uses end-to-end encryption so only the user's phone can decrypt location data, preventing the company from accessing personal information. Unlike other trackers, caritag collects no data and stores everything on German infrastructure. (Read more about the Caritag success story here)

Data sovereignty is especially vital in hybrid finance, where DeFi's transparency must align with TradFi's privacy mandates. ETOPay's self-custody wallets ensure users retain control, preventing data silos and breaches common in centralized systems.

Insights from ETO GRUPPE Experts

Drawing from ETO GRUPPE's heritage in enterprise software and fintech, our specialists emphasize the transformative potential of hybrid finance. As one ETO GRUPPE Web3 experts, Holger Köther, VP Web3 Services & Strategy, notes, "Bridging TradFi and DeFi is about creating compliant, sovereign systems that empower enterprises to innovate securely." This aligns with ETOSPHERES' focus on modular services which integrate seamlessly into traditional workflows.

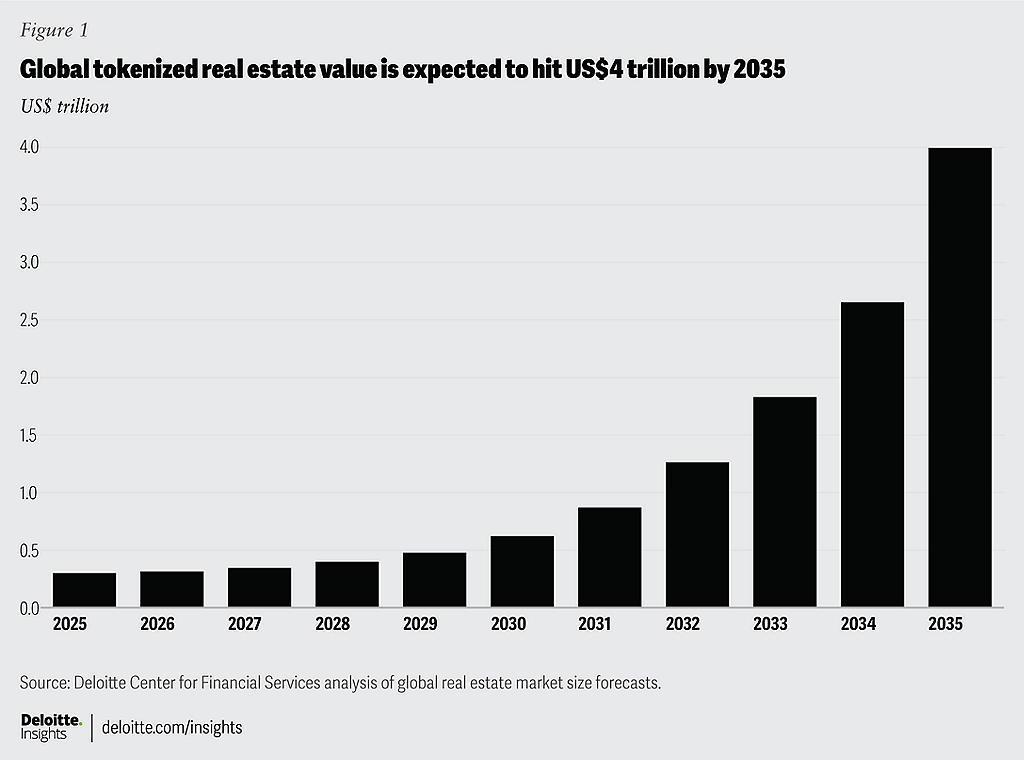

Industry reports echo this: The global decentralized finance market, valued at US$21.04 billion in 2024, is projected to reach US$1,558.15 billion by 2034, accelerating at a CAGR of 53.80% and driven by DeFi's expanding role in lending, payments, and institutional adoption. In 2025, Web3 and DeFi are maturing, with further integration into traditional finance expected to redefine global markets.

Market Growth: The Data Behind the Shift

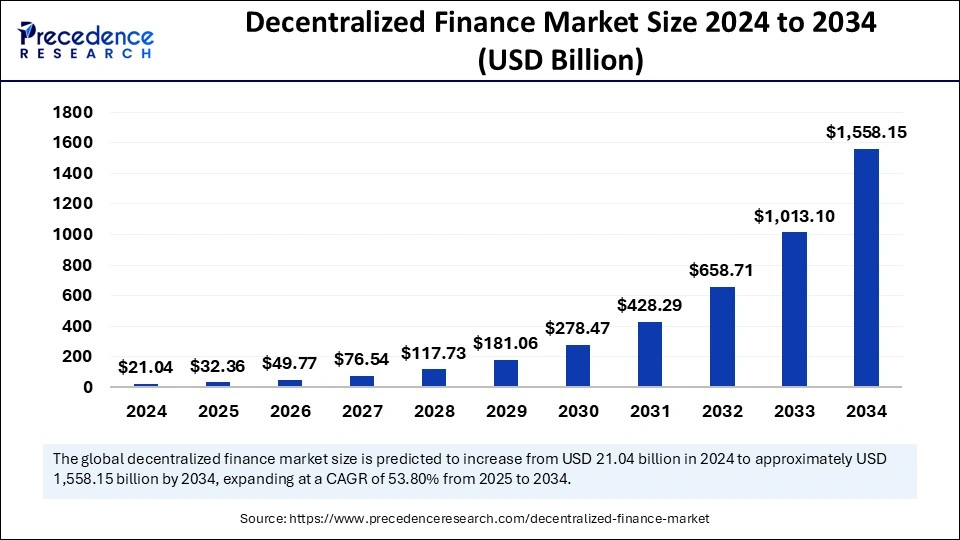

The convergence is backed by robust growth metrics. The U.S. DeFi market alone is surging from US$5.84 billion in 2024 to a projected US$441.15 billion by 2034, representing explosive 54.10% annual growth. Globally, DeFi trends in 2025 include regulatory clarity, institutional adoption, and the rise of real-world asset tokenization, paving the way for hybrid models. With DeFi protocols integrating legacy systems, enterprises can expect enhanced efficiency and new revenue streams.

Conclusion: Position Your Enterprise for the Hybrid Future

ETOPay is more than a payment SDK—it's a gateway to hybrid finance, aligned with ETOSPHERES' mission of data sovereignty and ETO GRUPPE's expertise. As TradFi and DeFi converge in 2025, enterprises adopting these tools will lead the charge toward a more inclusive, efficient financial landscape.

Ready to bridge the gap? Explore ETOPay and integrate today.

This is an article in our series exploring strategic approaches to Web3 authentication and compliance. Follow the ETOSPHERES blog and social media accounts for more insights on navigating the evolving regulatory landscape and crypto payment use-cases, while maximizing your competitive advantage through ETOSPHERES secure solutions.

ETOSPHERES is a modular Web3 service suite that combines EU-compliant data security with advanced digital wallet solutions. With a comprehensive service portfolio - from an advanced wallet SDK and Fiat On/Off-Ramp to billing and consent management, social features and AI-supported infrastructure - ETOSPHERES enables companies to seamlessly integrate user-oriented Web3 functions. Our unified interface provides a user-friendly interface for managing digital assets. Fully GDPR-compliant and developed in Germany, the platform offers scalable solutions for decentralized applications that revolutionize both customer loyalty and monetization.

Follow ETOSPHERES on X: https://x.com/ETOSPHERES

Follow ETOPSHERES on LinkedIn: ETOSPHERES