The Hidden Cost of Non-EU Crypto Wallets: Why GDPR Compliance Matters for Your Web3 Strategy

Innovation isn't enough. In Europe's Web3 market, GDPR, MiCA, DORA, and CAA compliance is key. Future-proof your growth with wallet solutions like ETOPay—built for security, trust, and EU regulations from day one. Compliance is your competitive edge.

In an era where digital and real-world tokenized assets (RWA) are revolutionizing finance, the compliance landscape is rapidly evolving, particularly within the European Union. The future of Web3 is impacted not only by innovation itself, but also by navigating the complex web of regulations that accompany it, ensuring operational integrity and consumer trust through robust and reliable wallet solutions.

Using non-EU crypto wallets might seem cheaper upfront because they skip compliance costs, but this shortcut can seriously hurt your business later. If you're running a Web3 project in Europe, you need to understand how GDPR connects with new rules like MiCA. This knowledge essential for any wallet service that wants to survive long-term with European users.

Let's dive into what really happens when you use non-EU wallets and why following the rules actually matters. We will show you where innovation meets compliance and how this balance can totally transform your strategy. Join us through this article to see how regulations, user experience, and growth connect in Europe's crypto scene.

Introduction: The EU Regulatory Landscape for Crypto Wallet Providers

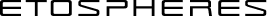

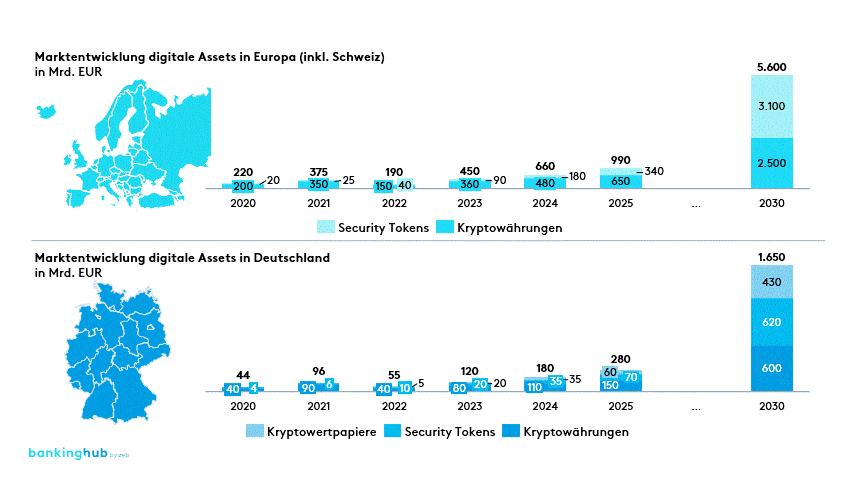

Over the past year, Europe has witnessed a staggering 65% increase in cryptocurrency adoption, underscoring the region's embrace of digital innovation. Yet, this surge is shadowed by growing regulatory scrutiny, notably through the European Union's stringent General Data Protection Regulation (GDPR) and the forthcoming Markets in Crypto-Assets (MiCA) regulation which affects online services including wallet providers.

This evolving framework places crypto wallet providers at a crossroads: innovate while maintaining necessary compliance. It's the classic tug-of-war between innovation versus regulation and the legal mandates that govern digital services and private services.

Our purpose here is clear: to underscore why integrating a GDPR-compliant wallet infrastructure is more than a box-ticking exercise but a strategic advantage. Safely navigating EU crypto regulations can elevate crypto and stablecoin integration from a basic tool to a sophisticated vehicle for secure, compliant business growth, especially when implemented with proper trust services.

DORA, CAA, GDPR and MiCA: The Quadruple Compliance Challenge for Web3 Companies

Navigating GDPR, MiCA, DORA, and CAA regulations regulations is a tightrope walk for service providers and wallet-app integration for stablecoin payments, trying to innovate while staying compliant.

GDPR focuses on data protection and privacy. Key requirements include data minimization, ensuring that only necessary data is collected, and the right to erasure, enabling users to request the deletion of their data. For wallet integration, this means implementing robust systems to manage user permissions and data retention policies effectively, often requiring electronic signatures and digital credentials for verification.

MiCA, the Markets in Crypto-Assets Regulation, introduces specific rules for crypto custody. Wallet providers must now adhere to stringent custody requirements, ensuring user assets are properly safeguarded. This involves proof of sufficient financial resources and technical measures to prevent unauthorized access, following eIDAS (electronic Identification, Authentication, and Trust Services) Regulation standards for trust services.

DORA (Digital Operational Resilience Act) adds another layer by requiring financial entities to maintain robust digital infrastructure. For crypto wallets, this means implementing comprehensive cybersecurity measures, regular stress testing, and incident response protocols to ensure service continuity even during attacks.

CAA (Critical Applications Act) focuses on applications which are critical to EU infrastructure, potentially including certain large-scale wallet service provision. It demands heightened security standards, transparency in operations, and adherence to EU values—requiring wallet providers to build additional safeguards for user protection and system stability.

In addition to these primary regulations, businesses integrating crypto payments must navigate several specialized frameworks. AML5/6 (Anti-Money Laundering Directives) require comprehensive customer verification processes, real-time transaction monitoring, and structured risk assessment systems to prevent financial crime. PSD2 (Payment Services Directive) becomes essential when bridging crypto with traditional banking, mandating strong authentication and secure communication channels. Companies must also implement sophisticated systems for VAT & Tax Regulations compliance, including transaction categorization, proper reporting mechanisms, and documentation practices that satisfy tax authorities across multiple jurisdictions.

European wallet providers face a complex regulatory landscape that requires careful navigation to ensure compliance while driving innovation. Understanding these four key regulations is essential for any Web3 business targeting European markets.

Compliance Checklist:

- Data Minimization: Only collect essential user data

- Right to Erasure: Provide clear mechanisms for data deletion requests

- Custody Security: Implement stringent security protocols for asset protection

- Operational Resilience: Ensure systems can withstand digital disruptions

- Critical Application Standards: Meet heightened security for essential services

- Incident Reporting: Establish clear protocols for breach notification

- Risk Assessment: Regularly evaluate vulnerability and threat landscapes

Here's a brief overview table:

| Regulation | Key Requirements | Impact on Wallet Providers |

|---|---|---|

| GDPR | Data Minimization, Right to Erasure | Privacy-by-design implementation, User data control mechanisms |

| MiCA | Asset safeguarding, Capital requirements | Enhanced custody protocols, Transparent asset management |

| DORA | Digital resilience, Incident management | Robust security infrastructure, Business continuity planning |

| CAA | Enhanced verification, Risk management | Stringent application controls, Ongoing compliance monitoring |

Successfully aligning especially with GDPR and MiCA is essential for fostering trust and long-term viability in the European market.

The True Cost of Non-Compliance: Financial and Reputational Risks

Failure to adhere to the EU GDPR can prove catastrophically costly for wallet solution providers. Consider the 2022 fine levied against a well-known fintech giant, which faced a €18 million penalty for non-compliance with data regulations. For larger entities, potential maximum penalties can soar to 4% of global annual revenue. Take a tech conglomerate with, say, a €100 billion turnover; they could face a staggering €4 billion fine.

Beyond fines, companies face hidden costs:

- Legal Fees: Defending against or negotiating penalties can amass steep legal bills for both legal persons and natural persons

- Technical Debt: Retrofitting existing systems to meet compliance can be resource-intensive

- Lost Market Opportunities: Non-compliance can bar access to lucrative European markets, including the single market

- Damaged Trust: Consumer confidence may plummet, taking years to rebuild, particularly affecting trust service providers

It’s clear: successfully navigating EU regulations demands both strategic foresight and meticulous planning. For wallet providers and integrators, compliance is a crucial element of business continuity planning for digital transformation initiatives.

Data Sovereignty: Building European-First Web3 Infrastructure

Data sovereignty is the principle that digital information is subject to the laws and governance structures within the nation it is collected. In the EU, this affects how companies manage data, emphasizing GDPR compliance and ensuring European data centers meet data localization requirements for wallet providers.

Benefits of EU Data Centers for wallet solutions:

- Reduced Latency: Locating data centers in Europe ensures faster access and better performance for European users, crucial for services like DeFi and real-time applications through mobile devices

- Increased Trust: EU businesses and consumers feel more secure knowing their data is stored locally under familiar legal frameworks with proper electronic signatures

- Legal Insulation: Hosting data within the EU provides insulation from non-EU legal demands, safeguarding against extraterritorial reach, particularly important for digital transactions

EU data centers do more than comply with regulations; they optimize for local needs and instill confidence. As Web3 expands, choosing EU infrastructure for wallet providers isn't just wise; it may be inevitable to maintain sole control over sensitive data.

Building a European-first Web3 infrastructure is about strategy, responsiveness, and trust, particularly for wallet providers handling customers and electronic transactions.

ETOPay: A Case Study in GDPR-Native Web3 Solutions

ETOPay solves the EU compliance headache for businesses wanting crypto payments without the regulatory nightmare. Built in Germany with European data standards from day one, it's not retrofitted compliance—it's native.

The SDK takes a "less is more" approach to data. It only collects what's absolutely necessary, encrypts it properly, and deletes it when it's served its purpose. No data hoarding, no unnecessary retention, no compliance risks.

What makes ETOPay different is its complete solution approach. While competitors offer partial solutions that leave businesses exposed to regulatory gaps, ETOPay delivers:

- Full KYC Integration: Postident verification built directly into the user flow—no browser redirects or third-party handoffs

- Fiat On/Off Ramps: Seamless conversion between crypto and traditional currencies with proper documentation

- Multi-Currency Support: Handling both crypto and fiat transactions with appropriate regulatory considerations

- Automatic Billing: Generating compliant invoices and receipts without additional systems

For developers, integration is straightforward with ready-made components:

- SDK support for Android, iOS, and web platforms

- Open-source core for transparency and auditability

- Comprehensive documentation and implementation examples

- European-based hosting technical support team

ETOPay demonstrates that regulation compliance doesn't require sacrificing user experience. The wallet maintains the speed and convenience of crypto transactions while satisfying the most stringent European requirements—enabling businesses to focus on growth rather than additional regulatory costs and legal firefighting.

Building a Future-Proof European Web3 Strategy

As Europe's digital landscape evolves, businesses must align with regulations like the EU's GDPR and MiCA to future-proof their Web3 strategies. The integration of compliant digital wallets is crucial.

- Is the wallet provider GDPR and MiCA compliant?

- How does the wallet ensure data sovereignty?

- What are the KYC measures integrated within the wallet?

- What level of security does the wallet offer for crypto assets?

- Is the wallet infrastructure based in a GDPR-compliant jurisdiction, such as within the EU?

- Does the solution support electronic signatures and other technical specifications required by eIDAS 2.0?

Now it's time to take decisive action by implementing these crucial steps to ensure your business stays both compliant and competitive:

- Conduct a compliance gap analysis with regulatory specialists familiar with crypto frameworks

- Select wallet services with proven EU regulatory compliance and European data hosting

- Ensure your provider offers comprehensive documentation for potential audits

- Establish clear data processing agreements that define responsibilities and liability boundaries

Looking ahead, Europe is poised to tighten crypto regulations, emphasizing consumer protection and privacy. Compliance is how you build trust and get ahead in this rapidly growing digital space. Smart businesses are flipping the script, seeing EU regulations as an opportunity rather than a burden. By partnering with wallet solutions that already have compliance locked down, you can focus on innovation while ensuring your digital transactions remain secure and legitimate.

👉 Ready to future-proof your platform? Get in touch with us today

This is the second in our series exploring strategic approaches to Web3 and compliance. Follow the ETOSPHERES blog and social media accounts for more insights on navigating the evolving regulatory landscape and crypto payment use-cases, while maximizing your competitive advantage through ETOSPHERES secure solutions.

ETOSPHERES is a modular Web3 service suite that combines EU-compliant data security with advanced digital solutions. With a comprehensive service portfolio - from wallet SDK and Fiat On/Off-Ramp to billing and consent management, social features and AI-supported infrastructure - ETOSPHERES enables companies to seamlessly integrate user-oriented Web3 functions. Fully GDPR-compliant and developed in Germany, the platform offers scalable solutions that revolutionize both customer loyalty and monetization.

Follow ETOSPHERES on X: https://x.com/ETOSPHERES

Follow ETOPSHERES on LinkedIn: ETOSPHERES