Stablecoins in EU E-Commerce: Lessons from Coinbase-Shopify and ETOPay's Compliant Edge

In the dynamic world of EU e-commerce, stablecoins are emerging as a game-changer, offering stability, low fees, and borderless transactions that traditional fiat systems struggle to match. The recent June 2025 collaboration between Coinbase, Shopify, and Stripe exemplifies this shift, enabling millions of merchants to accept USDC payments on the Base network for seamless, 24/7 global commerce.

This partnership highlights the potential of stablecoins to reduce friction in online retail, but for European businesses, regulatory compliance adds a layer of complexity. Enter ETOPay: an EU-first SDK that integrates stablecoins like EUROe and USDC while ensuring full MiCA adherence, data sovereignty, and GDPR compliance. As critical infrastructure for the EU's digital economy, ETOPay bridges the gap, allowing e-commerce platforms to harness stablecoin advantages without regulatory risks.

Lessons from the Coinbase-Shopify Collaboration

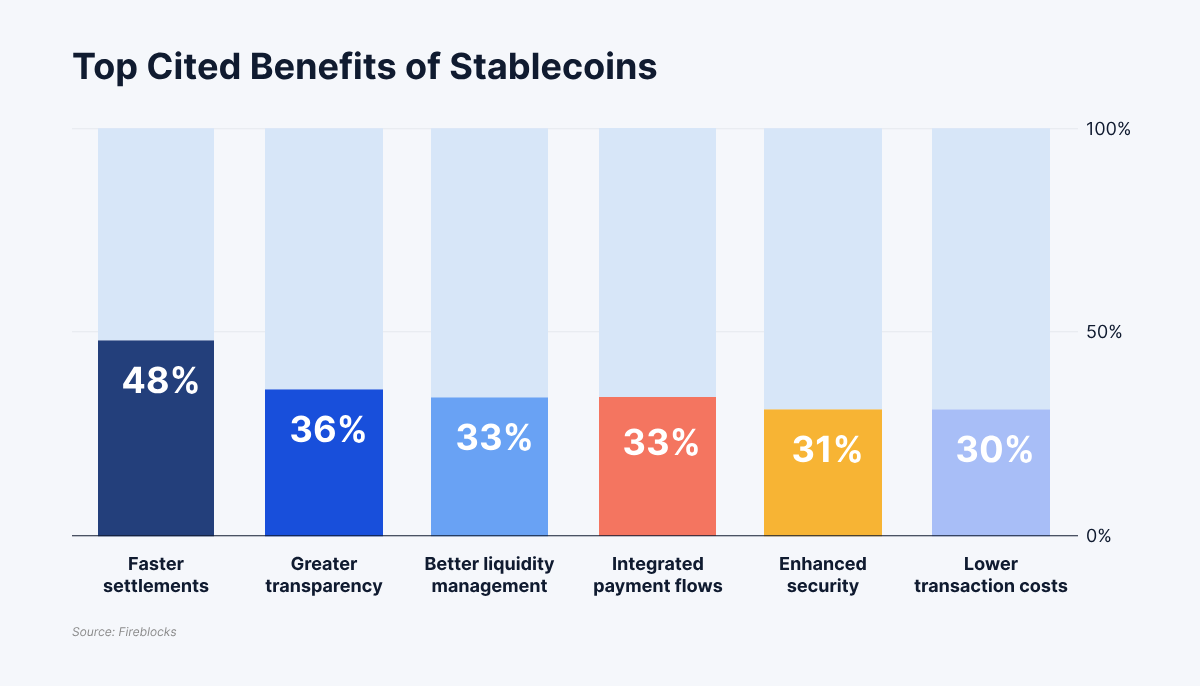

The Coinbase-Shopify integration, announced on June 12, 2025, marks a significant milestone in stablecoin adoption for e-commerce. By embedding USDC payments directly into Shopify Payments, merchants can now accept stablecoins without needing blockchain expertise, benefiting from instant settlements and lower costs compared to traditional card processors.

Key takeaways include:

- Borderless Accessibility: USDC enables payments from anywhere, bypassing FX fees and delays—ideal for Shopify's global merchant base

- Cost Efficiency: Transaction fees drop to fractions of a percent, with 24/7 availability, as Coinbase Payments handles the backend

- Simplicity for Merchants: No new integrations required; it's plug-and-play, boosting adoption among non-crypto-native businesses

This model has already shown promise, with early reports indicating faster checkout times and increased international sales. However, for EU merchants, US-centric solutions like this raise concerns about data privacy and MiCA regulations, which demand localized compliance.

Advantages of Stablecoins in EU E-Commerce

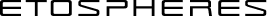

Stablecoins like USDC and EUROe address core pain points in the €899 billion EU e-commerce market, growing at 10-12% CAGR. Their peg to fiat currencies ensures price stability, while blockchain rails provide:

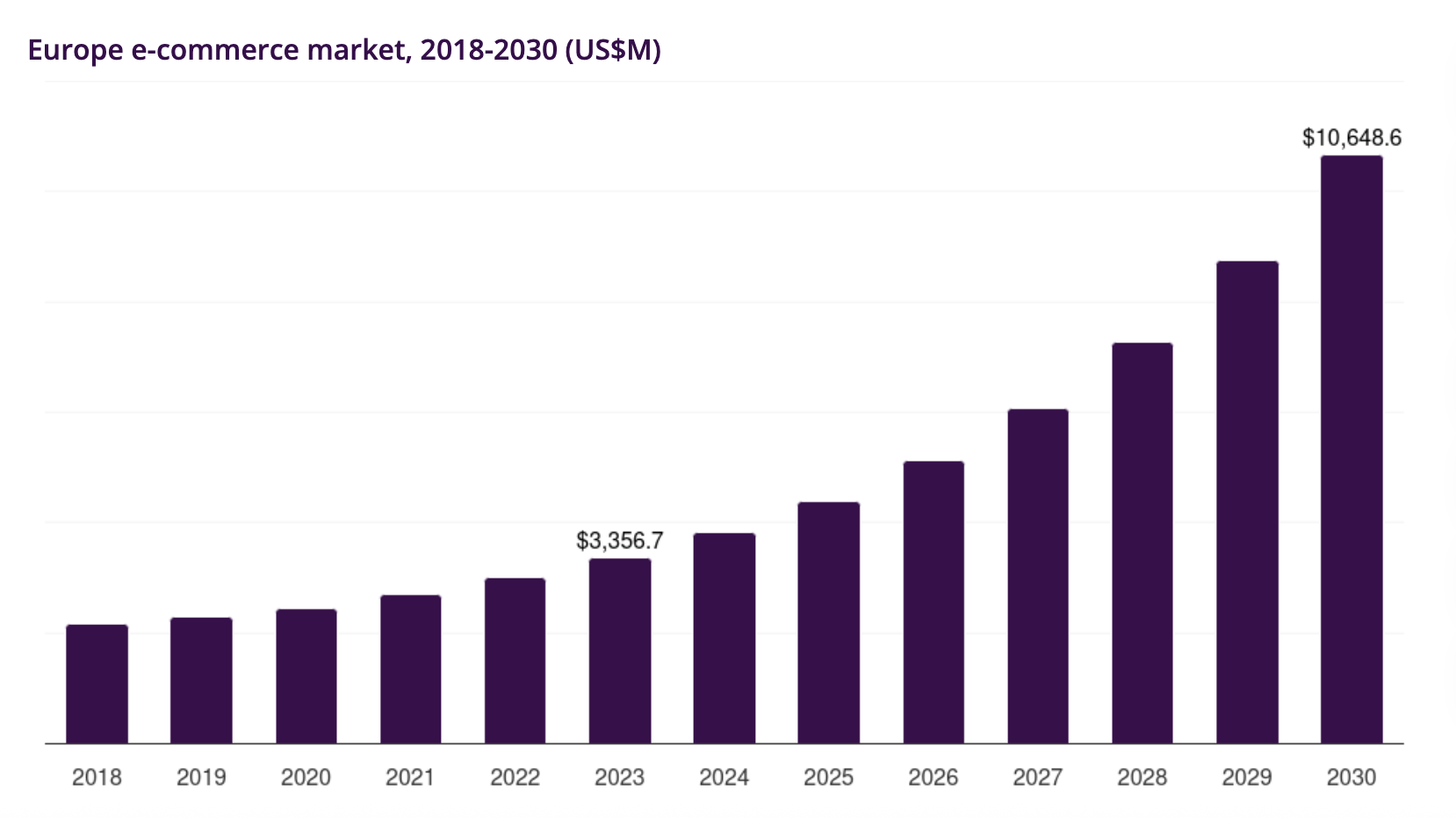

Reduced Fees and Faster Settlements: Traditional processors charge 2-4% with 3-7 day delays; stablecoins enable near-zero fees and instant transfers, saving EU businesses €60K-€120K annually on €5M volumes.

Programmability and Automation: Conditional payments, automated escrow, and multi-party splits streamline marketplaces—features echoed in Shopify's USDC for virtual goods.

Cross-Border Efficiency: With MiCA's stablecoin provisions effective since 2024, EUROe offers a compliant alternative to USDC, supporting seamless EEA transactions without volatility risks.

These benefits align with the EU's push for digital resilience, positioning stablecoins as foundational for e-commerce innovation.

ETOPay's Compliant Edge: EU-Critical Infrastructure

While the Coinbase-Shopify partnership accelerates global stablecoin use, ETOPay stands out as EU-critical infrastructure, tailored for MiCA-regulated environments. Our SDK enables:

Seamless EUROe and USDC Integration: Embed stablecoin ramps in days, with self-custody wallets and automated conversions via European banking partners.

Full Compliance Framework: Built-in KYC/AML, GDPR consent, and MiCA reporting—unlike US platforms, ETOPay operates in EU data centers, ensuring sovereignty and avoiding cross-border risks.

Enterprise-Grade Customization: White-label options and REST APIs for high-volume e-commerce, supporting programmable logic for commissions and refunds.

For instance, an EU e-commerce platform using ETOPay could mirror Shopify's USDC flows but with EUROe, achieving 40-60% cost savings while maintaining full regulatory alignment—critical under MiCA's 2025 enforcement.

Case Study Example: Boosting EU Merchant Adoption

Imagine a mid-sized German e-commerce platform specializing in sustainable fashion, based in Berlin, that handles approximately €2 million in annual sales. This company, EcoWear Berlin, sources eco-friendly apparel from suppliers across Europe and sells to customers in Germany, France, the Netherlands, and beyond. Traditionally, they've relied on processors like Stripe (1.5-2.9% + €0.25 per transaction), PayPal (2.9-3.49% + €0.35, plus 1.5% cross-border fees), and Adyen (1.5-2.5% via Interchange++), averaging 3% fees—or €60,000 yearly—eroding margins in a competitive market.

Settlement delays add pain: PayPal and Stripe take 1-3 days, bank transfers 3-7 days, tying up capital. Non-compliance risks under MiCA and GDPR could incur fines up to 4% of revenue.

Integrating ETOPay's SDK shifts to EUROe stablecoins, slashing fees to 0.5-1.5%—saving €30,000-€48,000 annually—while enabling instant settlements and full MiCA compliance via built-in KYC/AML and EU data centers. No dependency on US/Asian providers like PayPal or Stripe reduces geopolitical risks.

EcoWear mirrors Shopify's USDC gains but with EU safeguards: quicker French/Dutch conversions boost international sales by 20-30%. In the €708 billion EU e-commerce market (7.95% CAGR to 2029), ETOPay turns payments from cost center to edge.

Embrace Stablecoins with ETOPay

The Coinbase-Shopify collaboration proves stablecoins' transformative power in e-commerce, but EU businesses need compliant solutions to thrive. ETOPay delivers as essential infrastructure, combining stablecoin advantages with regulatory excellence. Unlock borderless, efficient payments today.

Ready to integrate? Visit https://etospheres.com to get started with ETOPay.

This is an article in our series exploring strategic approaches to Web3 authentication and compliance. Follow the ETOSPHERES blog and social media accounts for more insights on navigating the evolving regulatory landscape and crypto payment use-cases, while maximizing your competitive advantage through ETOSPHERES secure solutions.

ETOSPHERES is a modular Web3 service suite that combines EU-compliant data security with advanced digital wallet solutions. With a comprehensive service portfolio - from an advanced wallet SDK and Fiat On/Off-Ramp to billing and consent management, social features and AI-supported infrastructure - ETOSPHERES enables companies to seamlessly integrate user-oriented Web3 functions. Our unified interface provides a user-friendly interface for managing digital assets. Fully GDPR-compliant and developed in Germany, the platform offers scalable solutions for decentralized applications that revolutionize both customer loyalty and monetization.

Follow ETOSPHERES on X: https://x.com/ETOSPHERES

Follow ETOPSHERES on LinkedIn: ETOSPHERES