MiCA Compliance Without Compromise: How ETOPay Turns Regulatory Change Into a Competitive Edge

This essential guide is for forward-thinking platform operators, fintech leaders, and digital businesses looking to incorporate crypto payments while navigating the new regulatory landscape.

The Future of Crypto Payments Is Here. Are You Ready?

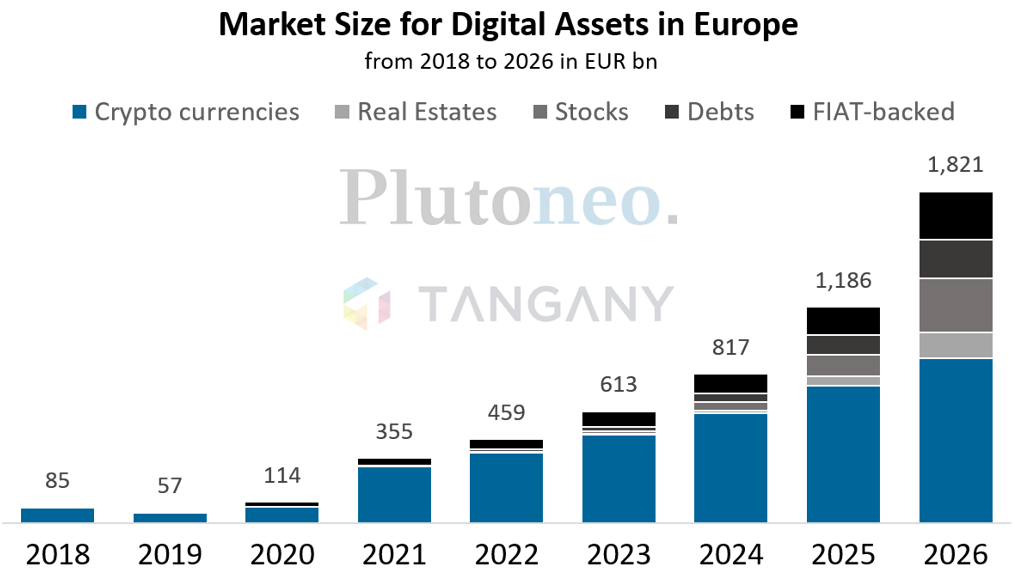

The Markets in Crypto-Assets Regulation (MiCA) is reshaping the crypto and payments industry in the EU. By establishing clear, standardized rules, MiCA is setting a new benchmark for security, transparency, and financial integrity. Businesses that fail to meet these standards will be left behind, while those that embrace compliance will gain a competitive edge in a maturing market.

But for many companies, especially startups working with tokens, MiCA brings increased compliance costs, legal complexities, and new operational requirements. For platforms integrating stablecoin and crypto payments, MiCA presents a huge opportunity—especially with the right partner.

ETOPay was built for businesses that want to offer crypto payments without worrying about compliance or infrastructure headaches. Our fully MiCA-compliant payment solution allows platforms to seamlessly integrate stablecoin transactions and crypto wallet payments, ensuring the first adopting organizations to stay ahead in the rapidly evolving market.

The MiCA Reality Check: A New Era for Crypto Compliance

For years, businesses facilitating crypto payments have operated in uncertainty.

MiCA changes that.

MiCA represents the EU's comprehensive regulatory framework designed to bring order to the crypto wild west. Implemented in 2023, it establishes clear legal guidelines for crypto assets, defines specific requirements for service providers, and creates dedicated rules for stablecoins.

What Does MiCA Require?

Under MiCA, companies aiming to offer crypto-related services must comply with several strict regulations:

- Mandatory Licensing – Crypto-Asset Service Providers (CASPs) must obtain a MiCA license to operate legally.

- AML & KYC Standards – Platforms must integrate full anti-money laundering (AML) and know-your-customer (KYC) checks into their payment flows.

- Consumer Protection Measures – Businesses must offer clear risk disclosures, transaction security, and strong liability protections.

- Capital and Liquidity Requirements – Platforms processing crypto payments must prove they have the financial stability to protect users.

The main takeaway:

To explore crypto payments, compliance is the first hurdle to clear.

New Revenue Streams: Lower Transaction Fees with Stablecoins

Stablecoins are rapidly gaining mainstream acceptance across diverse industries, with adoption accelerating as regulatory frameworks like MiCA provide clearer guidelines. From e-commerce and gaming to luxury retail and travel, businesses are embracing stablecoin payments to capitalize on dramatically reduced transaction costs

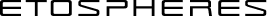

This trend, reflected in the exponential market growth from €85bn in 2018 to a projected €1,821bn by 2026, signals that digital assets adoption is already happening right now.

One of the biggest advantages of integrating MiCA-compliant stablecoin payments is the dramatic reduction in transaction costs compared to traditional payment systems like Visa, Mastercard, and PayPal.

Traditional payment processors charge merchants anywhere from 1.5% to 3.5% per transaction, plus additional cross-border fees, chargeback risks, and settlement delays. In contrast, stablecoin transactions on blockchain networks (including EVM-compatible chains) can cost as little as $0.01 depending on the network used (e.g., Solana, Polygon, or Layer 2 Ethereum).

Beyond cost savings, stablecoin payments settle instantly, compared to the 1–3 business days required for traditional credit card payments. The benefits are obvious: a reduction of cash flow friction, minimized chargeback risks, and higher efficiency and lower overhead.

ETOPay: Making Your Accountant Actually Love Crypto

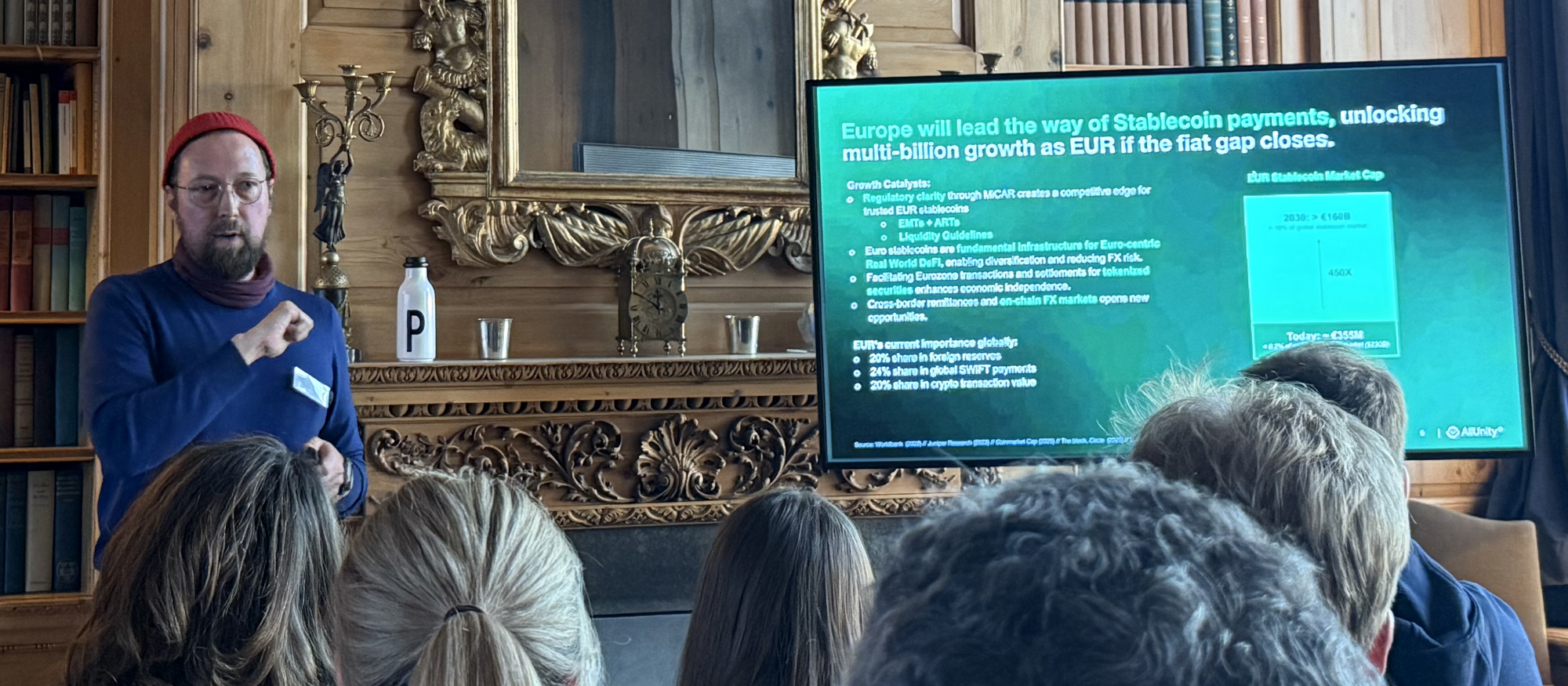

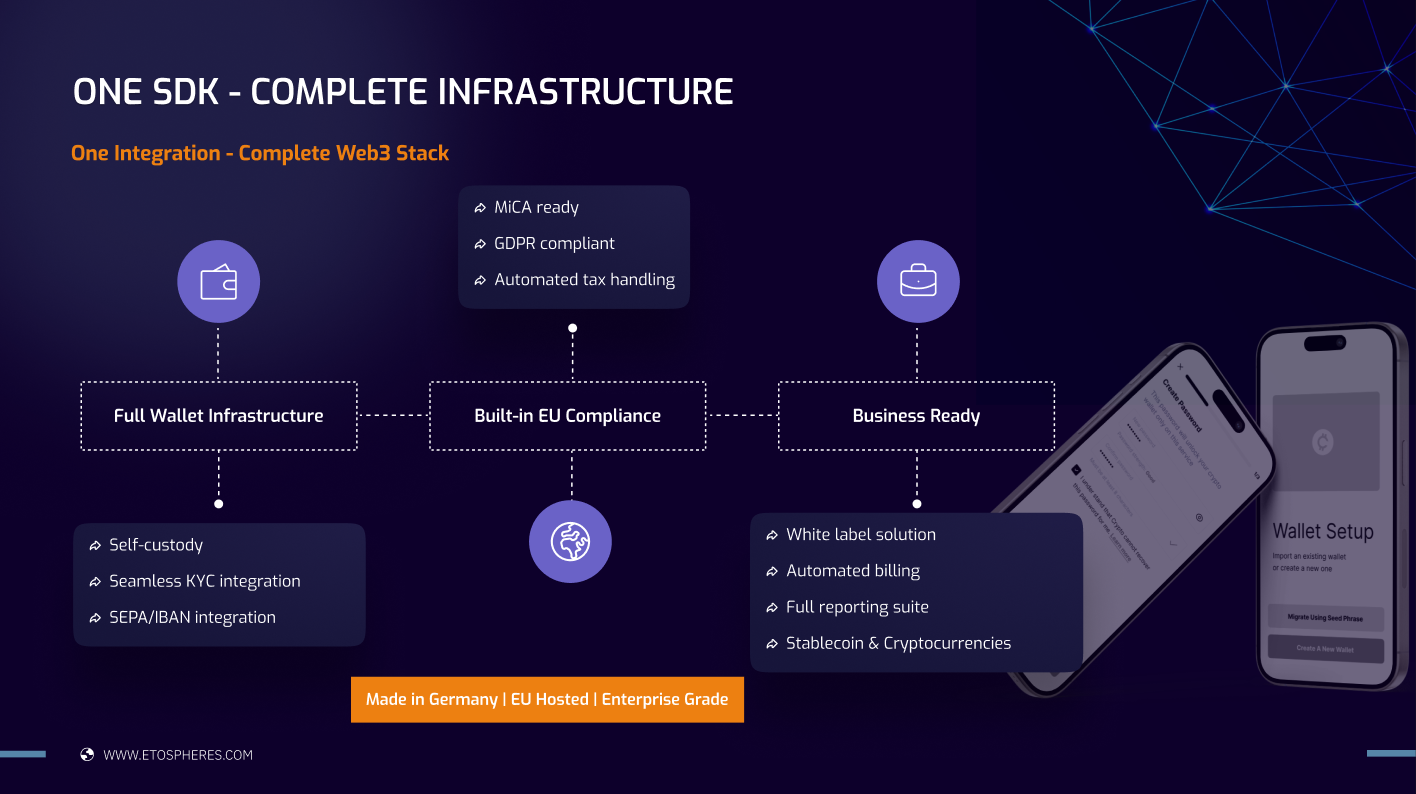

ETOPay is a complete, compliance-first infrastructure that allows businesses to offer stablecoin and crypto payments effortlessly. Instead of spending months navigating regulatory hurdles, platforms can integrate crypto payments in days using ETOPay's ready-to-deploy solution.

ETOPay was designed for platforms to offer seamless crypto transactions while ensuring MiCA, GDPR, and AML compliance.

- Regulatory-Ready Payment Processing

- Allow users transactions up to 99€ with bank verification; higher limits available after completing KYC.

- Instant fiat-to-crypto conversion with IBAN and SEPA integration.

- Transaction tracking, invoicing, and automated tax compliance.

- Support for stablecoin payments within a fully compliant framework.

- Built-in KYC & AML

- ComplianceAutomated identity verification with PostIdent KYC integration.

- Real-time fraud detection and compliance reporting.

- Fully GDPR-compliant wallet infrastructure with EU-hosted security.

- Advanced wallet management features for both businesses and end-users.

- Seamless Integration for PlatformsSingle

- Single Wallet SDK integration—no need for businesses to build compliance frameworks from scratch.

- Integrated and frictionless user experience, including KYC.

- Scalable architecture that adapts to e-commerce, content platforms, and gaming industries.

- Support for mobile platforms ensures accessibility across devices.

- Comprehensive developer tools to streamline implementation with minimal lines of code.

The SDK integration will be launched in April, with the exchange and invoicing features shortly after.

The main result

Businesses can focus on scaling, innovating, and monetizing their platforms—while ETOPay takes care of compliance.

The Future of Crypto Payments Belongs to the Compliant

MiCA is a market transformation and Businesses that embrace compliance today will be the dominant players of tomorrow!

👉 Ready to future-proof your platform? Get in touch with us today

This is the first in our series exploring strategic approaches to Web3 authentication and compliance. Follow the ETOSPHERES blog and social media accounts for more insights on navigating the evolving regulatory landscape and crypto payment use-cases, while maximizing your competitive advantage through ETOSPHERES secure solutions.

ETOSPHERES is a modular Web3 service suite that combines EU-compliant data security with advanced digital wallet solutions. With a comprehensive service portfolio - from an advanced wallet SDK and Fiat On/Off-Ramp to billing and consent management, social features and AI-supported infrastructure - ETOSPHERES enables companies to seamlessly integrate user-oriented Web3 functions. Our unified interface provides a user-friendly interface for managing digital assets. Fully GDPR-compliant and developed in Germany, the platform offers scalable solutions for decentralized applications that revolutionize both customer loyalty and monetization.

Follow ETOSPHERES on X: https://x.com/ETOSPHERES

Follow ETOPSHERES on LinkedIn: ETOSPHERES