Stablecoins and Cross-Border Trade: ETOPay's Role in EU Economic Integration

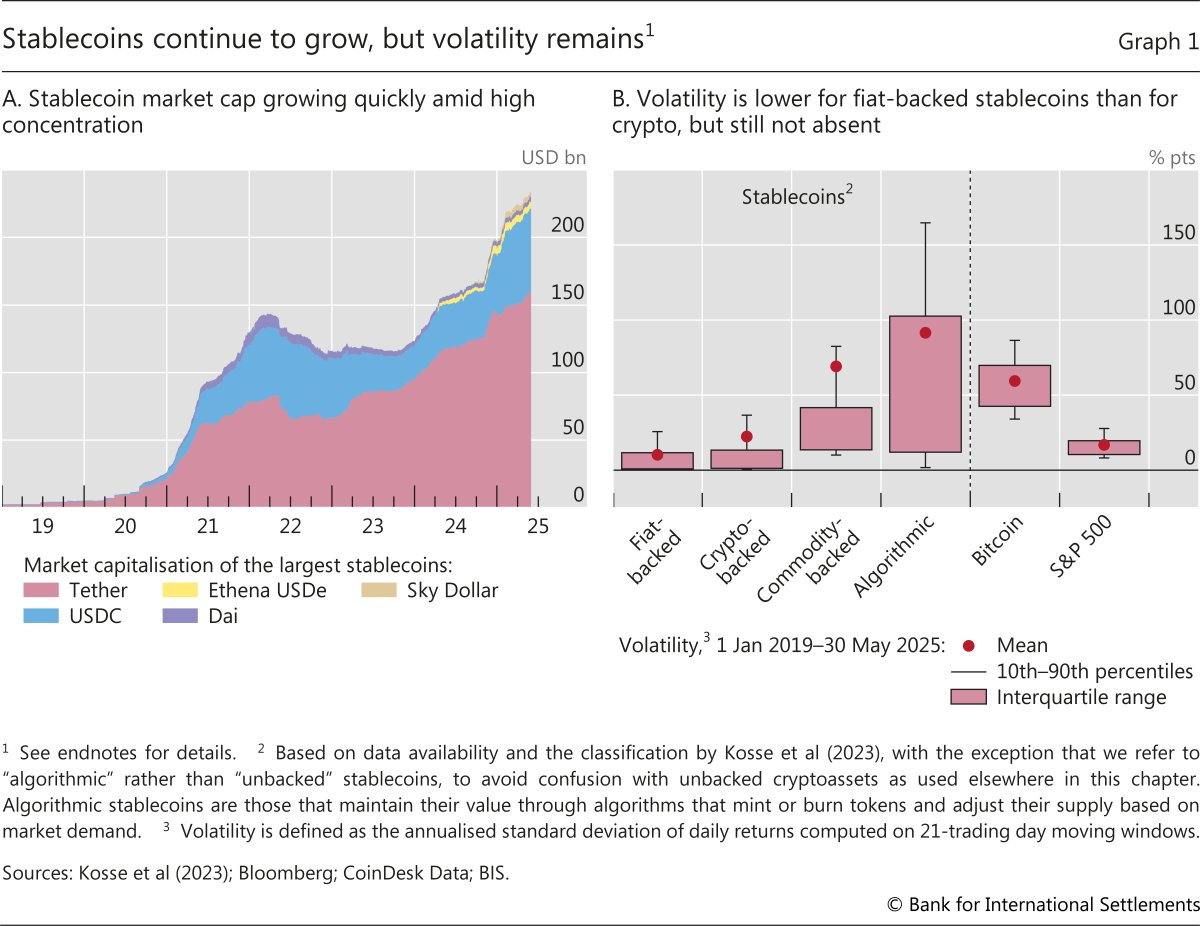

Cross-border trade is the lifeblood of the European Union's economy, with intra-EU goods exports reaching €4,025 billion in 2024—56% higher than extra-EU exports at €2,584 billion.

As we enter mid-2025, early data shows promising growth: EU exports surged 8.6% in Q1 2025, driven by stronger ties with partners like the United States.

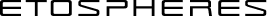

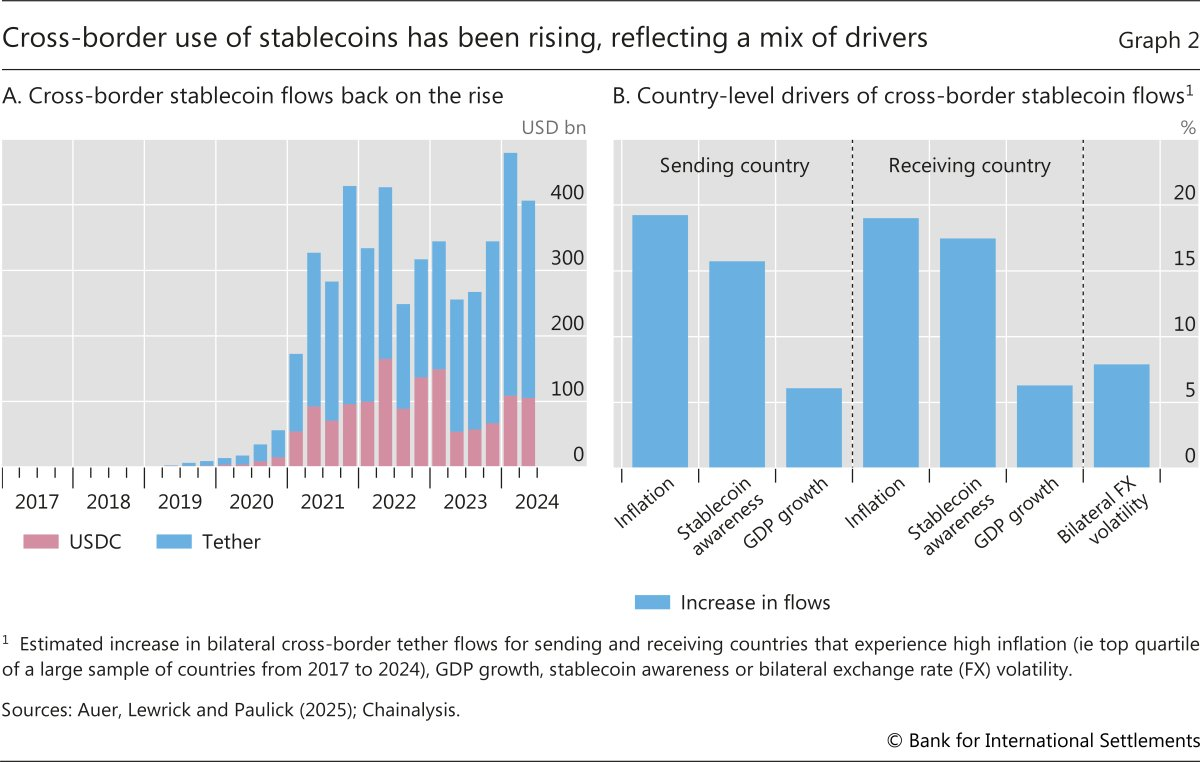

Yet, traditional systems plague this €5+ trillion market with high fees (2-4%), settlement delays (3-7 days), and FX volatility. Stablecoins like EUROe and USDC offer a revolutionary alternative: stable, instant, and low-cost transfers.

However, EU businesses need compliant tools to leverage them. ETOPay, with its MiCA-aligned SDK, positions itself as critical infrastructure, enabling seamless stablecoin integration while ensuring data sovereignty and regulatory adherence—fostering deeper EU economic integration.

The Scale of EU Cross-Border Trade in 2025

The EU's trade ecosystem is vast and evolving. In 2024, the bloc achieved a €147 billion surplus, a rebound from 2022's energy-driven deficit, with key sectors like machinery, vehicles, and chemicals leading surpluses.

Intra-EU trade dominates, but extra-EU flows are growing, especially in e-commerce and services. Q1 2025 data indicates exports up 8.6% and imports 4.1%, signaling recovery amid global uncertainties.

Challenges persist: High costs and delays hinder SMEs, while regulatory fragmentation complicates multi-jurisdictional operations. Stablecoins address these by enabling programmable, borderless payments.

Advantages of Stablecoins in Cross-Border Payments

Stablecoins pegged to fiat (e.g., EUROe to EUR) provide stability without crypto volatility, making them ideal for trade. Key benefits include:

Accessibility: 24/7 availability supports global trade, especially in emerging corridors like EU-India (+9% import growth in 2024).

Programmability: Automated escrow, conditional payments, and multi-party splits streamline B2B trade in marketplaces.

Speed and Transparency: Instant settlements (seconds vs. days) and blockchain traceability shorten capital cycles and reduce disputes.

Cost Reduction: Fees drop to 0.5-1.5% vs. 2-4% for traditional wires, with no FX spreads—saving 40-60% on international flows.

As noted in 2025 analyses, stablecoins could reshape payments by offering lower costs and faster speeds, particularly for cross-border scenarios.

The Regulatory Landscape: MiCA's Impact on Stablecoins

MiCA, fully enforceable since early 2025, harmonizes crypto regulations across the EEA, requiring stablecoin issuers to maintain 1:1 reserves and cap daily transactions at €200 million for non-euro stablecoins.

This framework boosts trust but imposes strict AML/KYC and reporting—favoring EU-native solutions over US-centric ones.MiCA accelerates stablecoin adoption in trade by providing clarity, with EUROe emerging as a compliant tool for intra-EU flows. It also enables passporting, allowing licensed providers to operate seamlessly across 27 states.

ETOPay's Role: Enabling Compliant Stablecoin Integration

ETOPay's SDK positions it as EU-critical infrastructure, integrating stablecoins into trade workflows with:

- Fiat-to-Stablecoin Ramps: Instant EUROe conversions via SEPA, compliant with MiCA reserves.

- Cross-Border Programmability: Self-custody wallets, MFA, and APIs for automated EEA transfers.

- Sovereignty and Compliance: EU data centers ensure GDPR, with built-in KYC and reporting.

For exporters, ETOPay would reduce settlement times from days to seconds, supporting the EU's €2.5+ trillion TAM in digital payments.

Enhancing EU Export Efficiency

A hypothetical Austrian machinery exporter (€5M annual volume) using ETOPay for EUROe payments to French buyers cuts fees by 50% and settles instantly—boosting cash flow amid 2025's 5.6% US export growth trend. Real-world parallels show stablecoins saving 40-60% in B2B trade.

Conclusion: Driving EU Integration with ETOPayStablecoins are pivotal for efficient cross-border trade, aligning with the EU's digital single market. ETOPay ensures compliant adoption, solidifying its role as essential infrastructure.Ready to optimize?

This is an article in our series exploring strategic approaches to Web3 authentication and compliance. Follow the ETOSPHERES blog and social media accounts for more insights on navigating the evolving regulatory landscape and crypto payment use-cases, while maximizing your competitive advantage through ETOSPHERES secure solutions.

ETOSPHERES is a modular Web3 service suite that combines EU-compliant data security with advanced digital wallet solutions. With a comprehensive service portfolio - from an advanced wallet SDK and Fiat On/Off-Ramp to billing and consent management, social features and AI-supported infrastructure - ETOSPHERES enables companies to seamlessly integrate user-oriented Web3 functions. Our unified interface provides a user-friendly interface for managing digital assets. Fully GDPR-compliant and developed in Germany, the platform offers scalable solutions for decentralized applications that revolutionize both customer loyalty and monetization.

Follow ETOSPHERES on X: https://x.com/ETOSPHERES

Follow ETOPSHERES on LinkedIn: ETOSPHERES